Follow the Money—how careless finance is ruining social care

Following the money that flows through the social care system, a new CUSP paper demonstrates how private equity firms have stacked some care home chains with shocking levels of debt and stripped them of their assets, likely creating in the process a level of economic precarity that threatens the stability of the whole sector. This blog is summarising the main findings.

Adult social care is in crisis. Demographic change, chronic underfunding and the impact of Covid-19 are pushing elderly care towards a ‘tipping point’ of imminent collapse. All of this is now well-documented. But behind this stark reality, our research has revealed a shocking insight: social care has become private equity’s goldmine.

Exorbitant fees for residential care suck money out of local authority budgets and from families struggling to provide care for those they love. Opaque corporate structures siphon off a steady stream of taxpayers’ cash and families’ savings into the offshore bank accounts of wealthy investors. All the while, frontline workers struggle daily with low pay and impossible working conditions that stretch them to their limits and threaten the quality of care delivered.

How has this been allowed to happen? Our new CUSP working paper takes a critical perspective on this process, looking closely at the roles of marketisation and finacialisation. We find that several core characteristics of social care make it poorly suited to being operated as a market, opening the door to predatory financial practices.

First, the time-based nature of care work means that there is limited scope for labour productivity (output per unit labour input) gains. In fact, labour productivity has declined in the social care sector over the last two decades. Intuitively that makes sense to most of us: if you ask a care worker to see more patients per hour, the quality of care will probably suffer. When care and attention form the very heart of the service you provide, drives for efficiency and productivity may end up delivering profit at the expense of quality.

Second, since local authorities buy services on behalf of a large number of people, they have the market power to set the price they are willing to pay for care unsustainably low. A decade of austerity and suffocating budget constraints has resulted in local authorities paying providers below the true cost of care in many parts of the country. Combined with consumers’ inability to access information about prices, this has led to a perverse hidden subsidy scheme, with many care providers charging private residents higher fees for the same care package, in an attempt to maintain profit margins.

Last, the emotional and physical trauma of moving from one care home to another—particularly for residents with a high level of need—renders the concept of consumer choice effectively meaningless. In reality, consumers have scant ability to freely express their preferences and exercise choice between providers. This enables providers to more easily express their own preference for profit, and leaves residents vulnerable to declining quality of care.

All told, these factors create deeply dysfunctional outcomes for the social care sector. Unmet need, low wages and poor-quality care are clear warning signals of what can happen when we apply market logics to a foundational welfare service like social care. They also place the sector in acute danger of predatory financial practices.

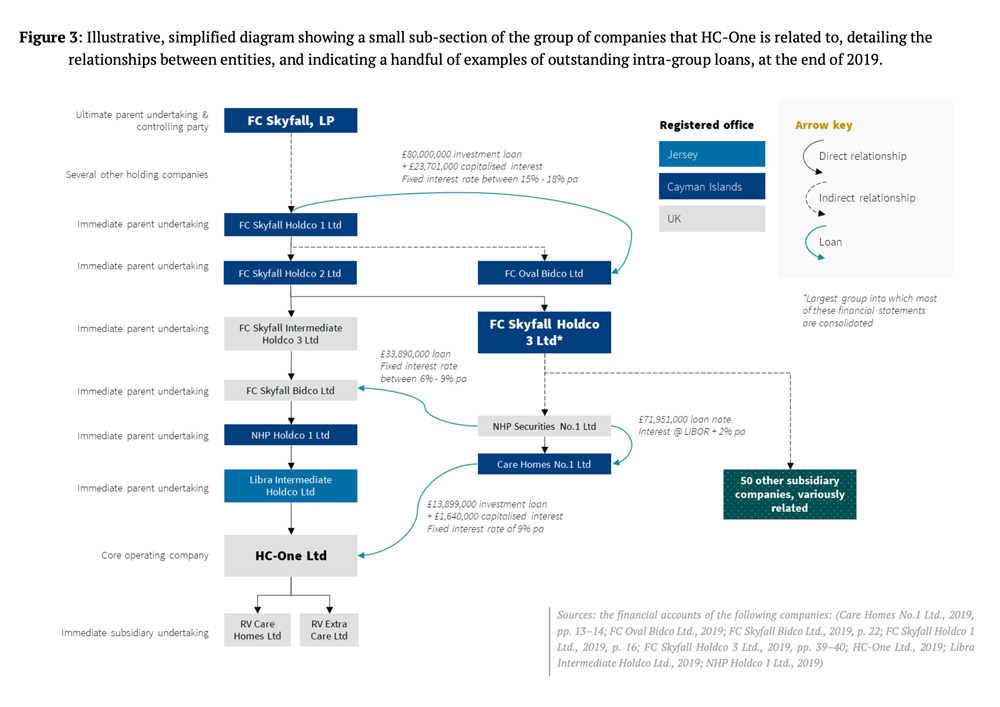

Following the money that flows through the social care system, our paper demonstrates how private equity firms have stacked some care home chains with shocking levels of debt and stripped them of their assets, likely creating in the process a level of economic precarity that threatens the stability of the sector. We identify how intra-group loans, offshore tax havens, and sale and leaseback arrangements are used to support the rapid extraction of cash out of the core social care business. A process that appears to be paid for by cuts to services, low wages and poor working conditions. These arrangements combine to create a clear moral hazard and, we argue, represent an explicit strategy to shift costs, socialise risks and privatise the benefits of investing in social care.

The collapse of Southern Cross in 2011 and the movement of Four Seasons Health Care into administration in 2019 offer a stark warning about what can happen when financial engineering goes badly wrong, with Southern Cross employees reporting that the company had been “run down to rack and ruin”. Despite this, private equity deals continue to be made, social care companies continue to be bought and loaded with debt, and ruthless financial practices continue to place care home residents in a position of heightened risk. Even now, as Rishi Sunak turns his back on social care in the wake of the most devastating crisis since WW2, fortunes are continuing to be made, and the ongoing cost is the silent tragedy of the most vulnerable in society.

Taken together these insights bust the myth of ‘unaffordability’ in social care. The UK’s social care market creates countless distortions to the real cost of provision. It has exposed the families in the squeezed middle to excessive fees. It has locked local authorities into opaque cross-subsidies between private profit and the public good. It has facilitated an unforgiveable transfer of wealth from the poorest to the richest in society. In the process, it has facilitated the conditions for both financial fragility and operational failure across the sector.

The post-pandemic recovery represents a once-in-a-generation opportunity to overhaul these conditions and transform adult social care. Our paper makes the case for that transformation all the more urgent.